If you’re working in Venture Capital or are fundraising from VC’s, the odds that you’ve experienced a lack of diversity in race, gender, and as a result ideas, is very high.

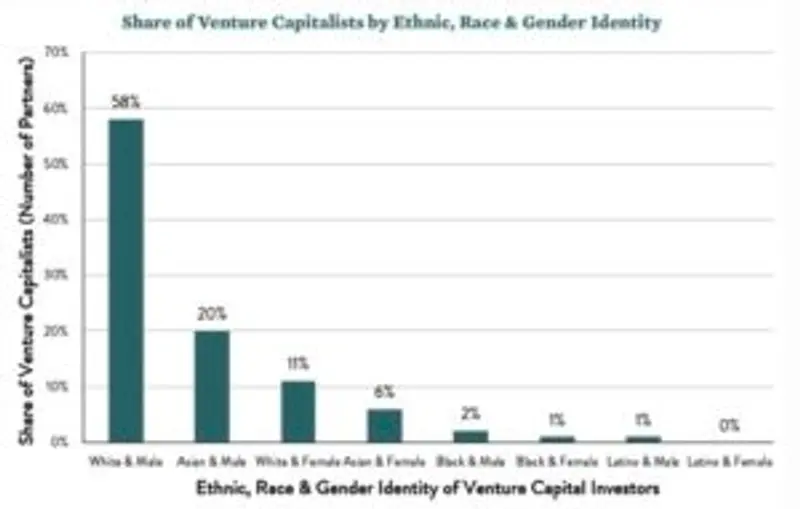

According to a survey by Richard Kerby at Equal Ventures, the VC industry is comprised of 58% white men, followed by 20% Asian men, 11% white women, 6% Asian women, 2% Black men, and 1% Black women, 1% Latinx men, and nearly 0% are Latinx women.

And when you consider “who controls venture capital dollars”, in other words, “who gets the bulk of the carried interest, salary… and ultimate control over which startups get funded”, it’s 93% white males. (Source)

Source: James L. Knight Foundation; data extrapolated from Figure 41 based on Preqin’s data set, which defines venture capital as a subset of private equityH VENTURE PARTNERS

Meanwhile, a report by McKinsey and Company shows that diverse working environments financially outperform homogenous workforces by as much as 35 percent.

The Venture Capital industry is missing out on diversity of people, ideas, ventures, and ultimately higher returns.

If you’re interested in helping improve diversity at your VC fund, check out these resources to start taking actionable steps forward.

1) Increase Your Individual Knowledge about Diversity and Inclusion

It’s important to remember to take ownership of your diversity and inclusion education process rather than burdening minority groups with the responsibility of teaching you or correcting you.

You can start by checking out this curated list of relevant articles on diversity and inclusion for both founders and funders. The list also includes a list of organizations you can work with to help improve diversity and inclusion including Parity.org, NVCA VentureForward, and Project Include.

These resources are curated by Founders for Change, a group of inspiring founders who are dedicated to diversity and inclusion within their companies, and desire greater diversity at the highest levels of VC firms. Learn more about Founders for Change here.

2) Encourage Your Fund to Take Part in the Diversity VC Standard Program & Certification

The Diversity VC Standard program is a great way to strategically set diversity goals for your fund while also increasing the knowledge of D&I practices for your whole team. It was started in 2020 and pioneered by 15 leading funds across Europe and Canada. The certification sends signals to the rest of the ecosystem that your fund follows the best D&I practices.

The program walks VC’s through three stages:

- Assessment – A guided run through of your fund’s current policies and practices

- Consultation – Curated advice and recommendations on next steps according to fund targets

- Certification – To Level 1 (setting a benchmark above industry average) or Level 2 (leading the way on changes to D&I policy)

For more information about Diversity VC follow this link.

3) Broaden Sources of Dealflow Beyond Traditional Channels

While cold outreach does sometimes work, most deals are funded through a warm introduction from someone in your network. For this reason, it’s a good idea to reflect on who comprises your network and decide if you need to branch out.

Some advice from Sarah Millar, Principal at City Light VC and head of Diversity VC’s US Chapter —

Be intentional about building relationships with funds that focus on diverse founders and leverage those to grow your own networks. Setting up regular catch-ups, co-investing in their deals, and sharing deals is always what works in VC – so being intentional about who you do it with and what their focus areas are is going to pay dividends.

Harlem Capital has put together a thorough database of diverse investors that is a great starting point.

You can also broaden your dealflow sources by checking out these resources: Crunchbase’s Diversity Spotlight, the Black Founder List, Latinx Founders Collective, Female Founded Club.

4) Guide Portfolio Companies on How to Build an Inclusive Culture

As a VC, you’re oftentimes in a position to influence your portfolio companies as they grow. Get informed about what makes a diverse and inclusive culture so you can guide your portfolio companies as they build their teams.

A great place to learn about inclusive cultures is by checking out the resources put together by Project Include. The non-profits mission is to give everyone a fair chance to succeed in tech by using data and advocacy to accelerate diversity and inclusion solutions.

Project Include has even curated recommendations on each step in the process of building an inclusive culture, including how to lead as a VC.

Leading the change to improve diversity at your VC fund may not be easy but we hope these resources serve as a source of motivation and encouragement.

5) Explore Diverse Networks when Making your next Fund Hire

When looking to add talent to your VC firm, start by exploring organizations on a mission to increase diversity in Venture Capital.

- Vencapital is empowering the next generation of investors by providing training programs catered specifically towards women and minorities looking for entry-level roles in VC.

- Chicago:Blend is on a mission to advance diversity, equity and inclusion in Chicago’s venture capital and startup community. They publish annual diversity data, help underrepresented and overlooked professionals break into VC, and deploy necessary DEI resources to the community.

You may also like How to Hire for your First VC Platform Role.

Do you have suggestions for other steps or resources you think we should include? Let us know!